HOMEBUILDER: MONTH- AND YEAR-END PROCESSES

Learn how to close the books at month- and year-end and what to do for multi-currency and non-construction inventory items ...

In This Article:

Period-End Processes | Non-Construction Inventory Items | Month-End Currency Revaluation

Note

- Always perform all parts of this document for the Year-End and not just the section marked as Year End.

- Most Homebuilders will only need to pay attention to the following (however, it is advisable to read through the whole document to ensure you are not missing something):

- AP.

- Bank.

- Date Control.

- Year End.

Important

- If you have more than one currency, e.g., CAD and USD read first the Month End Currency Revaluation for Multicurrency Environments article.

- If you use Non-Construction Inventory Items, read first the Non-Construction Inventory Items article.

Month- and Year-End HomeBuilder Processes

Accounts Receivable

To reconcile the subledger to the general ledger for foreign currency accounts, the Adjust Exchange Rates Periodic routine must be run first.

- Print the Aged Accounts Receivable Report by Transaction Date

- The filters on the Customer tab can be left blank unless you are using multiple accounts in the general ledger and wish to print the report by Customer Posting Group.

- Enter the period ending in the “Aged as of” field.

- Select Aged by Trans date.

- Agree the balance on the Aged AR report to the GL control accounts.

- Investigate any discrepancies. Generally, the only way to put the subledger out of balance is to post directly to the subledger account through the GL or to forget to run the Adjust Exchange Rate periodic. (more on this in Month End Currency Revaluation for Multicurrency Environments).

Accounts Payable

To reconcile the subledger to the general ledger for foreign currency accounts the adjust exchange rates periodic routine must be run first (details in Month End Currency Revaluation for Multicurrency Environments)

- Print the Aged Accounts Payable Report by Transaction Date.

- The filters on the Vendor tab can be left blank unless you are using multiple control accounts and wish to print the report by Vendor Posting Group.

- Enter the period end in the “Aged as of” field.

- Select Aged by Trans date.

- Agree the balance on the Aged AP report to the GL control accounts.

- Investigate any discrepancies.

Bank Accounts

To reconcile the Bank Account subledger to the general ledger for foreign currency accounts, the adjust exchange rates periodic routine must be run first.

On the general tab, the G/L Balance $ is the balance in the general ledger as of the statement date. The next field is the G/L Balance which is simply the G/L Balance $ converted to the foreign currency at the exchange rate as of the statement date. If you have not run the exchange rate adjustment this will not agree to the bank statement regardless of whether all items have been reconciled.

- Complete the bank reconciliation for each account.

- Print the Bank Acc. – Det. Trial Balance report. The report will show the balances in the currency of the bank as well as the local currency.

- Agree the local currency value to the balance to the GL.

- Investigate any discrepancies. Start by filtering the GL entries in each control account for the source code GENJNL.

Date Control

Important

Always ensure that you have both an “allow posting from” and an “allow posting to” date. If, for instance, you are missing the "allow posting to" date, you are allowing the system or that user to post at any time in the future.

Date Control- All Users

- Search General Ledger Setup, then in the General Ledger Setup page change the date ranges to the new period.

Date Control- User by User

- An individual user may have wider or narrower dates than the system dates. A classic scenario here is that the accounting team can post into last month and this month whereas general users can only post into this month.

- To override the date ranges for posting by user go to User Setup. This is not the same as the User table, this is in addition to it and you must create records in this table to turn on this functionality.

- As with the system-wide dates always ensure that from and to dates are selected (never have one date filled in leaving the other date blank).

- If you leave both dates blank, the system-wide dates are available for that user.

Tip

There is an additional control in the User Setup associated with a special field on the GL Entries and Tax Entries called Tax Date. If you would like to know more about this topic, read this article from Microsoft.

Year End

Closing the Financial Year and Posting to Retained Earnings

Note

- Once the year has been completed and all transactions entered, the financial year can be closed in a three-stage process (these instructions are a basic reminder only; please contact your system administrator if you are not completely sure how to close the year).

- After marking the Accounting Periods as closed, all this routine does is to take all accounts marked as Income Statement (on the GL Account card) and zero them out in a General Journal. The balance of this journal is then posted to a Retained Earnings Account.

Procedure

Tip

While you are on the Accounting Periods page, we recommend creating a new year at the same time. Most commonly, all that is required is to click on the Create Year button, view the suggestions on the next screen, and click OK unless you need periods that are not calendar months for 12 months.

- Accounting Periods – Close the year:

- From within the Accounting Periods Page click on the buttons – Actions and then Close Year.

- Follow the instructions.

- Note this is not easy to undo so make sure you do not need to make period date changes after this process.

- Run the “Close Income Statement” routine to populate a General Journal

- Fiscal Year Ending Date is automatically filled in, if it is incorrect check your period closing.

- Enter a clean Gen. Journal Template (usually “GENERAL”) and Batch.

- Add a recognizable Document Number.

- Add the Retained Earnings Account if it is not automatically added or change if you want retained earnings to be posted to a different account.

- Add a recognizable Posting Description.

- In the Close By area select all the Dimensions that are used in the GL and select the Business Unit Code if you are in a Consolidation Company.

- Click OK and move to the final step.

- Post the General Journal that was just created for you:

- Go to the General Journal Template and Batch that you selected in the previous step.

- If the entries look reasonable post the journal.

- The year is now closed, and the entries are made in the general ledger against the year-end posting date with a “C” in front of the date.

- you may make further back-dated posting entries if required.

Non-Construction Inventory Items

Important

Only required if you use non-construction inventory items; if not, skip to the next section, Month End Currency Revaluation for Multicurrency Environments.

Inventory Cost Adjustment Process

Month end procedures related to inventory should be done as close to the month end or period end as possible.

- Post all receipts and shipments on or before the month end date. Post any adjusting entries in the item journals. Invoice all jobs that can be invoiced.

- Investigate and correct Negative Inventory Quantities.

Important

If you do not correct negative Remaining Quantity values, you will have incorrect inventory values. If you leave this for more than a few months, it can become very difficult to correct and catch up.

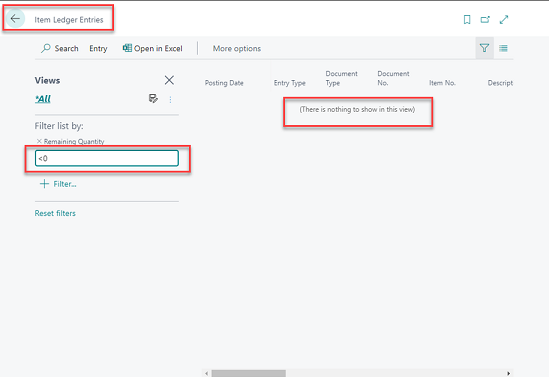

- Search for “Item Ledger Entries” from the magnifying glass.

- Filtering the Item Ledger Entries for Remaining Quantity < 0

- The list should be empty as shown below. If not, adjust inventory as required to eliminate negative inventory.

- Run the inventory periodic activities. The adjust cost routine ensures that all costs from positive item ledger entries have been passed on to the appropriate negative or sales item ledger entries. For example if you received an item at $0 cost because you did not know the purchase price then sold this item the cost of goods sold is $0. Subsequently you posted the purchase invoice at $10 then the system has to find the sales entry and increase the cost of goods sold to $10.

More on this on MS Learn:

Important

Make sure that you have run the inventory periodic activities BEFORE assessing any inventory reports or values. You will be wasting your time if you try and assess inventory before completing this task.

- You should run both inventory periodic activities even if you have turned on all the automated adjustments in the Inventory Setup – if all the automated cost adjustment run at the time of posting then these periodic activities will complete immediately

- Firstly, run the periodic activity Adjust Cost – Item Entries. From Financial Management Menu / Inventory / Costing / Adjust Cost Item Entries. Make sure that Posting is checked on, click OK

- Note 1: you will not get a report from this process.

- Note 2: the date on which the transactions are posted (related to a closed period) is the “Allow Posting From” date from the General Ledger Setup.

- Secondly, run the periodic activity Post Inventory Cost to GL (report) Select Per Entry on the options tab and check on Post.

- Note: The “Per Entry” option will create many value entries; if there is a requirement to restrict growth of the database size, choose the “Per Group” option, e.g., for use with many stores in a ChargeLogic installation

Inventory Periods (Normally Not Used)

Close the Inventory Period if you use it.

The reasons to use and the consequences of not using the Inventory Period Table are as follows:

- Maintaining the Inventory Periods means that inventory adjustments are not posted to a month that is closed and reconciled.

- If you do not maintain an Inventory Period list, then adjustments, e.g., rounding, can be made dating all the way back to the originating transaction, e.g., purchase.

Note

The Inventory Period table is structured using “End Date,” unlike the financial Period table, which is structured using “Start Date.”

-

Open the Inventory Periods page.

-

Go to the period that you wish to close.

-

Click on the “Close Period” button in the ribbon – Accept the message by pressing Yes.

-

From now any adjustments will be made only in the open period rather than going back to the original transaction and adjusting at that date.

-

Please note that you must open the general system periods (irrespective of the user periods) to allow the system to post cost adjustments into the new period. To do it, search: Accounting Periods.

- Ensure that you have BOTH from and to dates.

Inventory Reconciliation

-

Print the Inventory Valuation and Inventory to GL Reconcile Reports.

- Print the Inventory Valuation report. On the Options tab, enter the period end date as the “As of Date”.

-

Print the Inventory to GL Reconcile Report. On the Options tab, enter the period end date as the “As of Date”. - The far left column of the Inventory to GL Reconcile Report should agree to the Inventory Valuation report.

-

Reconcile the Inventory to GL Reconcile Report to the inventory accounts in the General Ledger. The Inventory to GL Reconcile Report will explain the difference between the sub-ledger and the general ledger. These differences are generally from Received Not Invoiced and Shipped Not Invoiced amounts.

- If required, you should book an accrual for the 'received not invoiced.' Create an entry to debit inventory and credit the accrued Accounts Payable balance on the value in the 'Received Not Invoiced' column on the Inventory to GL Reconcile Report.

- As an alternative to the Inventory to GL report, you may choose to use the AP to GL Reconcile report instead. The AP to GL Reconcile report will pick up all purchasing lines where the quantity 'received not invoiced' is populated. It will also use the direct unit cost on the purchase line, which may be different from the estimated cost in the item ledger entries.

Month-End Currency Revaluation – For Systems With Multiple Currencies

Important

Only required if you have more than one currency, e.g., CAD and USD; if not, skip to the next section, “ar, ap, and bank.”

Explanation

To reflect the current value of all foreign currency balances you need to run the “Adjust Exchange Rates” periodic activity. This process will revalue all open foreign currency receivables, payables, and bank balances. This process must be run to have the aged receivables, and payables and to reconcile your foreign currency banks. The recommended approach is to record a month beginning rate to be used to value all transactions during the month. Then record a month-end rate to revalue all open transactions.

Currency Table Setup

Note

If the automated currency update routine is running there is no need to maintain the following table.

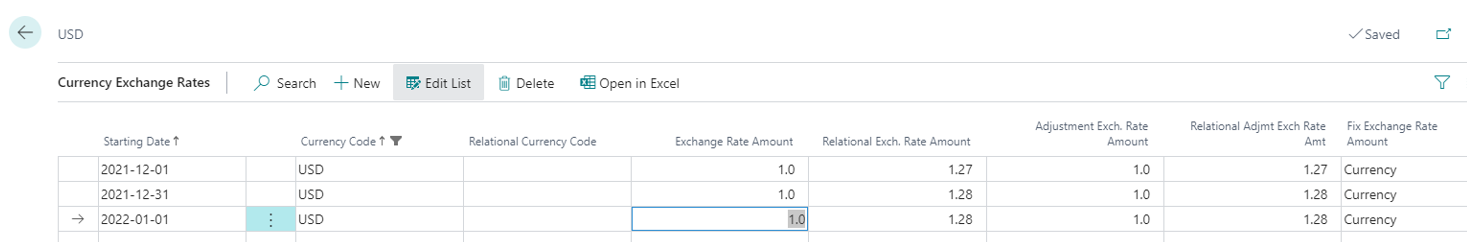

For example:

-

Enter the month-ending rate in the currency table.

-

Select the currency and click the Exch. Rates Button. The entries in this table should be like the above example.

Monthly Update Routine

Important

Make sure that you have run the Adjust Exchange Rate function after correctly setting up the currency tables and before assessing any foreign currency-based reports or values. You MUST do this before you try to assess currency-based sub-ledgers (AP, AR, and Bank) before completing this task.

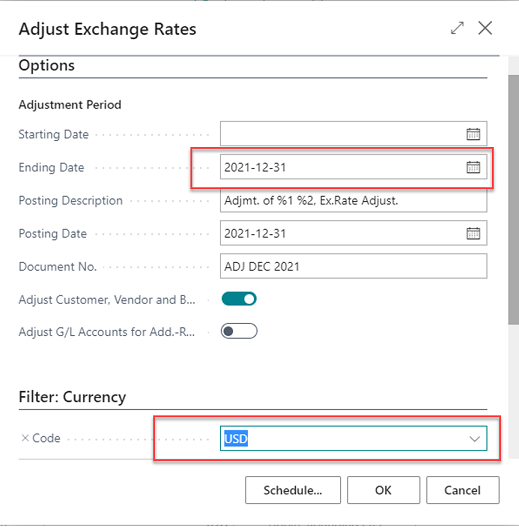

Run the Adjust Exchange Rate function.

- Enter the currency you are going to adjust.

- Enter the period end date as the ending date. Leave the start date blank. This means adjusting all open entries regardless of what the invoice date was.

- Leave the recommended description as is. The %1 and %2 reflect codes that will end up giving you the currency code and amount adjusted in the description field of the GL entry.

- Enter a document number. Ideally, something that will easily identify this as the result of the currency revaluation. For example, ADJ DEC 2021.

- Check the Adjust Customer, Vendor, and Bank Accounts.

Click OK. Note: No report will print.

Note

To review the effect of the adjustment, you can print the GL Register, or you can look at the Exch. Rate Adjmt. Registers. When you post the application of cash or post a check, the unrealized gain or loss is reversed, and a realized gain is posted. It is because of this process that the adjusted exchange rate cannot be run historically. All entries that were paid after the month's end will not be revalued as they are no longer open. To avoid this situation, do not apply foreign currency cash against customers or vendors prior to balancing the accounts.