HOMEBUILDER: WORK IN PROCESS (WIP)

If you use the Work in Process (WIP) subledger to manage operations, learn the calculation methods and use-cases in HomeBuilder ...

In This Article:

Intro to WIP | Percent of Completion Method | Completed Contract Method | Re-Opening Completed Contract

Work In Process (WIP) in HomeBuilder Introduction

Only some Homebuilders use the Work in Process (WIP) subledger to manage their operations. Most do not use it as the perceived value of information does not justify the additional administrative burden the organization would have to bear. We observed that the larger and more complex a builder's operations are, the more inclined they are to use WIP. Also, for multi-year projects like land development, using WIP might be useful.

There are two WIP calculation methods that are used by Builders:

- Completed Contract.

- Percentage of Completion.

Time and Materials Projects are not commonly used by homebuilders, which is why we did not include them in HomeBuilder Help articles. These Projects do NOT use WIP.

Note

Work in Process is also called Deferred Revenue.

The standard Business Central functionality does offer additional WIP calculation methods:

- Cost of Sales.

- Cost Value.

- Sales Value.

These will not be covered in our Help articles, as our homebuilding clients never use them.

Percentage of Completion WIP Calculation Method

Percentage of Completion calculates WIP as the contractual value (sales value) of actual usage cost value (Project ledger entries), measured by the cost value of expected usage (your budget). Using this method means that the revenue and profit (or loss) of the Project will be recognized as the Project costs are incurred and recognized. The Percentage of Completion method is recommended by some international accounting standards.

For this method, the WIP Amount is always posted to the WIP Accrued Sales account (an asset account), while the value of the Contract (Invoiced Price) will be posted to the WIP Invoiced Sales (contra asset or liability account).

The WIP is calculated with the following formula:

- WIP Calculation for Percentage of Completion Method = WIP Amount in Project Task - Invoiced Sales Amount in Project Task.

- WIP Amount in Project Task = Usage Total Cost + Schedule (Total Cost) * Contract (Total Price).

- Invoiced Sales Amount = Contract (Invoiced Price).

- WIP Sales Amount = WIP Amount.

- Recognized Sales Amount = WIP Amount.

- WIP Cost Amount = Usage (Total Cost).

- Recognized Costs = Usage (Total Cost).

In short, this method will calculate WIP based on your costs incurred (Usage Total Cost) vs. your Budget Total Cost. (This is where the percentage is calculated from)

This is a more complex method. Its advantage is that the revenue is being recognized simultaneously as the costs are recognized which results in financial information reflecting progress in incurring costs and reflects that on the revenue side.

- You must have a budget on the Lot to use this method (as it uses the Budget Total Cost to calculate your Percentage of Completion as you incur actual costs).

Completed Contract WIP Calculation Method

WIP Amount = WIP Cost Amount = Usage (Total Cost). WIP Sales Amount = Billable (Invoiced Price).

The Completed Contract does not recognize revenue and costs until the Project is complete. You may want to use this method when there is high uncertainty around the estimates of costs and revenue for the Project.

All usage is posted to the WIP Costs account (asset) and all invoiced sales are posted to the WIP Invoiced Sales account (in your example an asset account, but it can be a liability account) until the Project is complete.

In short, everything goes to the WIP subledger until you set the Project Status as Completed. You do not recognize costs or revenue until the project status is set to Completed.

This is a simpler of the two methods to grasp and use.

Project Posting Setup

We recommend the following setup for your WIP:

To access, search Project Posting Groups.

The descriptions of the G/L accounts used in the Project Posting Group Setup are as follows:

- WIP Costs Account.

- This is your base WIP account. Specifies the work in process (WIP) account for the calculated cost of the Project WIP for Project tasks with this posting group. The account is normally a balance sheet asset account.

- WIP Accrued Costs Account.

- Specifies an account that accumulates postings when the costs recognized, based on the invoiced value of the Project, are greater than the current usage total posted if the WIP method for the Project is Cost Value or Cost of Sales. The account is normally a balance sheet accrued expense liability account.

- Project Costs Applied Account.

- Specifies the balancing account for the WIP Cost account for Projects. The account is normally a balance sheet accrued expense liability account or an expense (credit) account.

- G/L Expense Acc (Contract).

- Specifies the sales account to be used for general ledger expenses in Project tasks with this posting group. If left empty, the G/L account entered on the planning line will be used.

- WIP Accrued Sales Account.

- Specifies an account that will be used when the revenue that can be recognized for the Project is greater than the current invoiced value (for the Project) if the work in process (WIP) method is Sales Value.

- WIP Invoiced Sales Account.

- Specifies the account for the invoiced value, for the Project for Project tasks, with this posting group.

- Project Sales Applied Account.

- Specifies the balancing account to WIP Invoiced Sales Account The account is normally a contra (or debit) income account.

- Recognized Costs Account.

- Specifies the account for recognized costs for the Project. The account is normally an expense account. At the end of the WIP process, this is where all the costs are going to end up.

- Recognized Sales Account.

- Specifies the account for recognized sales (or revenue) for the Project. The account is normally an income account. At the end of the WIP process, this is where all the revenue is going to end up.

Note

There are 4 accounts that were not populated in the Project Posting Setup:

- Item Costs Applied Account.

- Resource Costs Applied Account.

- G/L Costs Applied Account.

- Project Costs Adjustment Account.

These G/L accounts are used by the other WIP Calculation methods, typically not used by homebuilders (or even other industries). However, if your operations require them to be configured, you can commonly:

- Create a G/L Account WIP Costs Applied Account.

- Use it to populate all 4 Project Posting Group Categories.

- If you need more granular financial tracking, you can create additional G/L Accounts and assign them to the 4 Project Posting Group categories.

Important

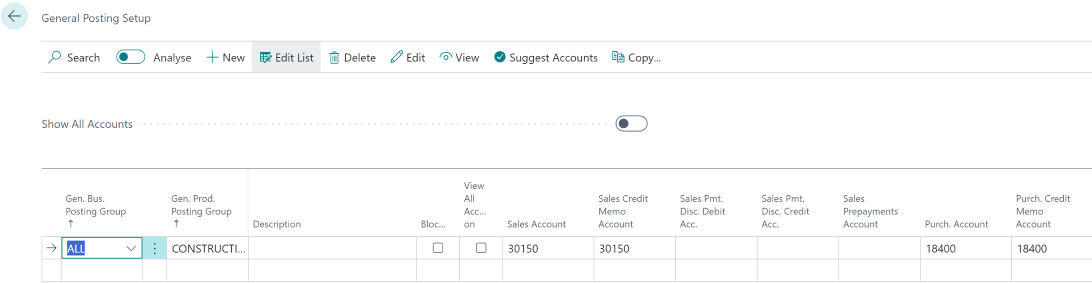

Search General Posting Setup and ensure its completeness. Specifically, select the COGS Account.

Lot Budget

Projects in Business Central are Lots in Homebuilder. That means that some functions regarding calculation WIP on the Lot will require to search and use Lots, and sometimes search Projects and use Projects functionality.

Details on setting up and managing Budgets can be found in these articles:

To perform WIP calculations, you will need a Budget on the Lot. The budget is inherited from the actual model that will be constructed on the Lot or from a "template Model" that you just assign to the lot to create Budget Lines common to all the Lots.

It is a brand-new budget with no postings in it.

This is a budget on Lot 9, and it is shown here as Project 9. We will use this same budget for both WIP Calculation Methods. Select the link below to navigate to the Method you will be using:

or

Note

- Lot Planning Lines contain detailed lines, i.e., there could be a couple of lines for each Project Task Number. However, when you search Projects and look at the Budget Total Cost field, you will notice that it contains 1 line and the sum of costs per Project Task Number.

- The main interplay is between HomeBuilder Lot Planning Lines and Business Central Projects Module and their Budget (Total Cost) and Actual Cost fields.

- In 2024, Business Central changed the table/ functionality name from Jobs to Projects. The screenshots still contain the old name, i.e., Jobs

Note

WIP G/L Postings do NOT contain any Dimension information. (Lot, Phase). This information is recorded during the process of:

- Purchasing.

- Selling.

from your Planning Lines. Planning Lines contain this information, and Purchase (or Sales) Lines inherit this information from them.

WIP Percent of Completion Method

In this example, no actual costs have been posted to the Lot/Project yet. Search for the Project and select the Project Card.. (In 2024, Business Central changed the table/ functionality name from Jobs to Projects. The screenshots still contain the old name, i.e., Jobs)

Note

This article builds upon your knowledge of the section, Work In Process (WIP) in HomeBuilder.

- Posting to the Lot SV1-L009 will show the booking in the Project0009.

- Running WIP on the Project Card via the WIP Menu and then selecting Calculate WIP will show no changes as there are currently no actual costs or revenue.

- Also, relevant G/L accounts have no balances.

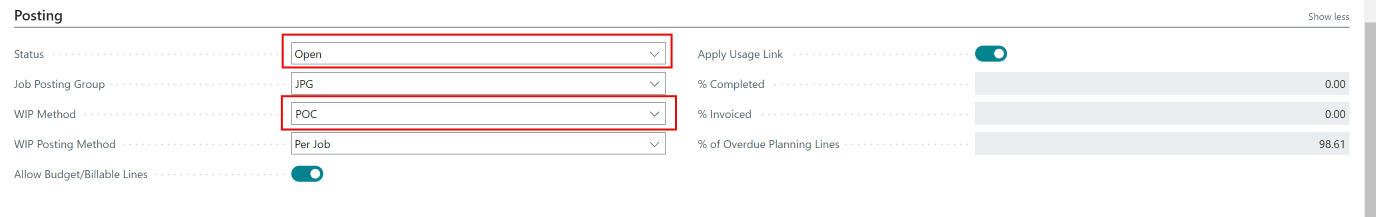

- The setup on the Project Card, posting FastTab, is as follows:

Now, post $100,000 against a Planning Line on that Lot.

Note

To learn more about how to book costs against a Lot Planning Line, read Purchasing Using Vendor Contracts.

Calculate WIP Action

At this point, WIP and Recognition FastTab on the Project Card still have zeroes. On the Project Card, go to the WIP Menu and select Calculate WIP.

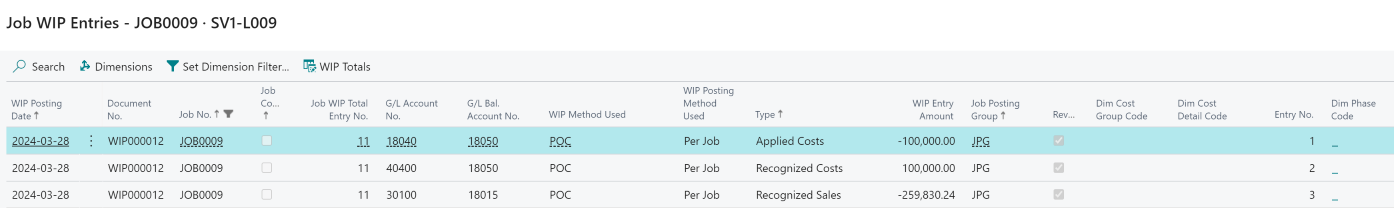

This is going to result in the following WIP Subledger Postings:

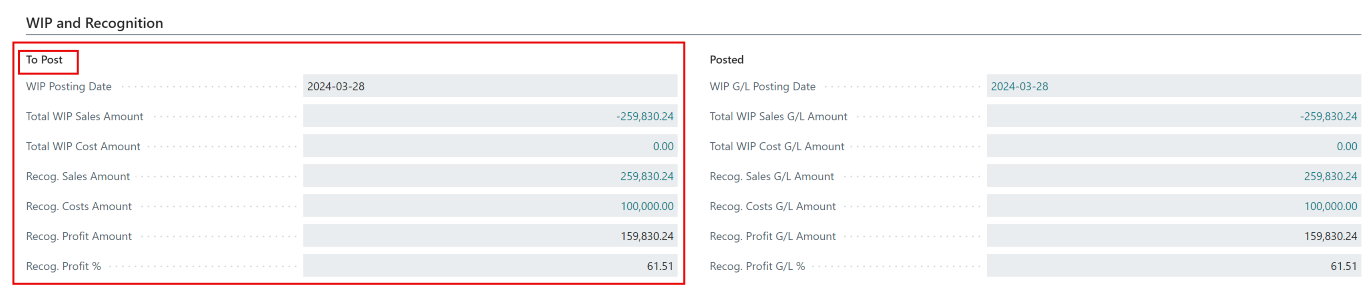

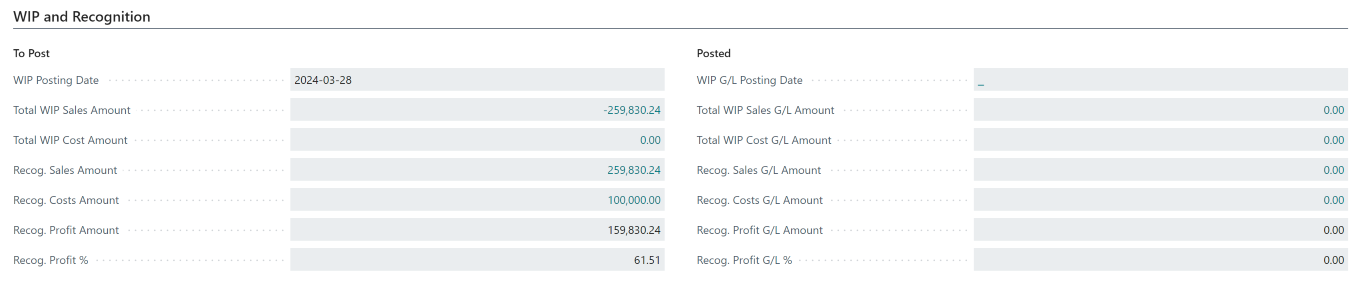

On the WIP and Recognition FastTab, the first numbers appear:

At this point, if you check Planning Lines on the Project (Project Card, then click Project Menu and select Project Planning Line) you will notice that the Invoiced amount is still $0, but Qty. to transfer to Journal is also 0 rather than 1 like for all the remaining lines.

When you look at HomeBuilder Lot Planning Lines (Search Lots, then select Lot Planning Lines cue) you will notice that $100000 is shown as the Posted Total Cost

The Planning Lines total for this lot is:

- From the Homebuilder Planning lines: 230,920

- From the Project Card Planning lines: 230,920

So identical in both places.

The budget total:

- The revenue from the Project (and also Lot) Planning Lines for this lot is 600,000

- From Homebuilder is: 500,920. It contains a Cost Detail Name line "Land" for $270,000 not included in the Project Card Budget. $500,920 - 270,000=230,920

- From the Project Card Budget is: 230,920

Important

- The Budget Total from the Project Card is used to calculate the Percentage of Completion. (NOT the Budget Total accessed from the HomeBuilder Lot)

Percentage of Completion Formulas and Examples Explained

For the Percentage of Completion WIP Calculation Method, the system uses the following formula:

- Costs Amount/Project Budget= % of Completion.

In the example:

- 100,000/230,920=43.305%

Then it uses the % of Completion to recognize the Sales Amount using the following formula:

- % of Completion * Billable (Total Price).

In the example:

- 43.305% * 600,000=259,830.24

Note that the system will recognize Revenue even when no revenue is yet billed (invoiced).

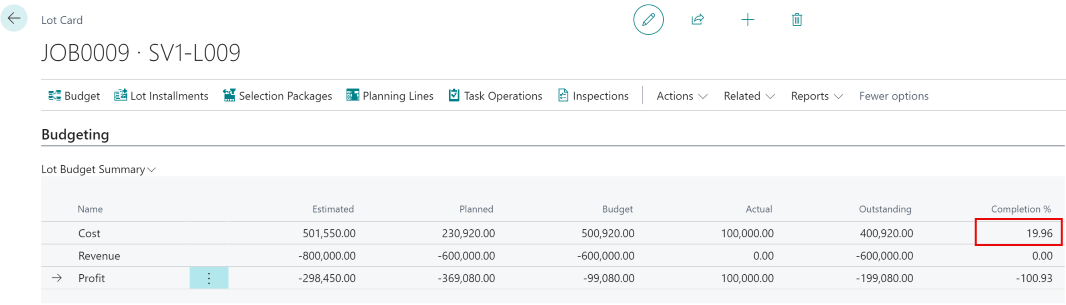

Important

The Budgeting numbers found in the Lot Card budgeting FastTab rely on the Lot Budget (500,920) and therefore show different Completion %

- 100,000/500,920=19.96%

Note that this Completion % is NOT used for the WIP calculations which use the one found on the Project Card.

Note that the Calculate WIP Action is affecting the WIP subledger only, i.e. there are no postings in the G/L yet.

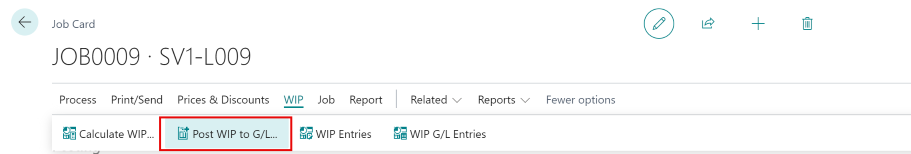

Post WIP to G/L

There are a few approaches to the frequency of Posting WIP to G/L.

- Daily/ immediately, in an attempt to complete the process fast and reflect operations in the G/L. Often the same person will run the "calculate WIP" Process and immediately run "Post WIP to G/L".

- Business Central will display messages encouraging you to follow that process.

- Weekly, as part of the revision routine, posting to G/L takes place.

- Monthly, as part of the month closing routine. You can choose the frequency that fits your operations best.

To start posting to G/L, on the Project Card, go to the WIP Menu and select Post WIP to G/L:

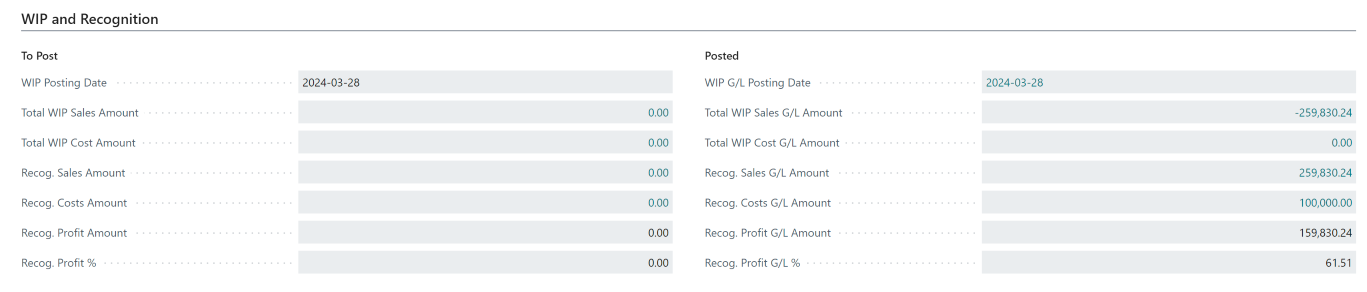

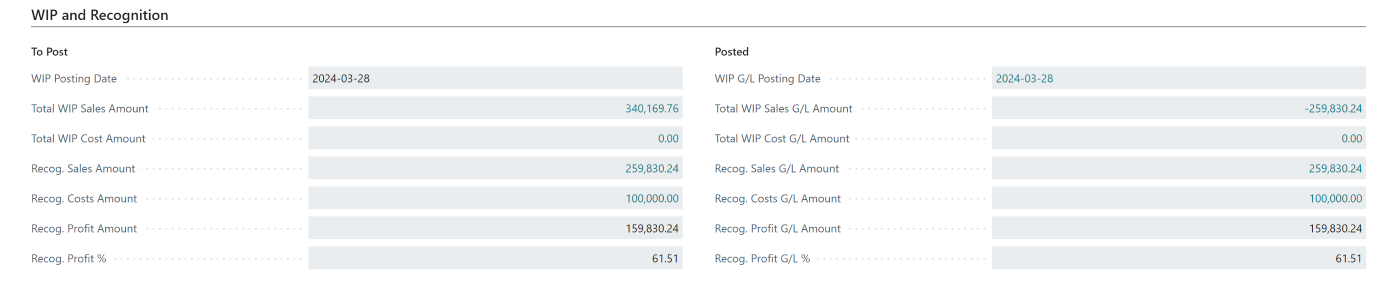

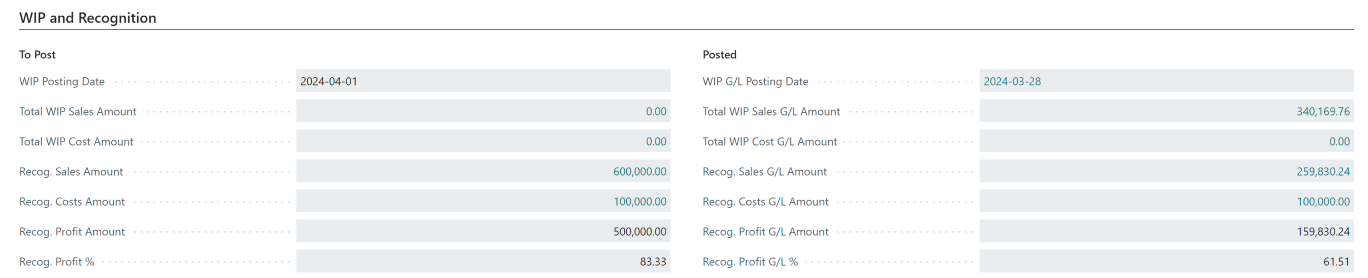

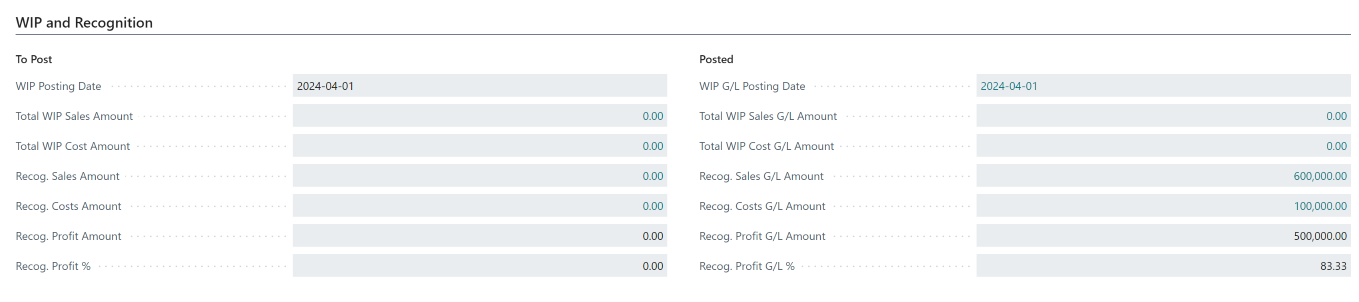

This is how the results of the process are represented in the Project Card: (WIP and Recognition FastTab)

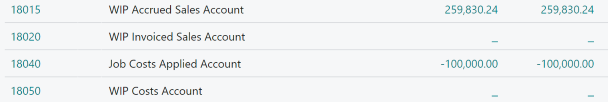

As expected, this operation will affect G/L:

We will also have recognition of costs: DR 40400 Cost of Sales 100,000 and recognition of 43.305% of 600,000 revenue resulting in CR 30100 Sales- Houses 259,830.24

Note

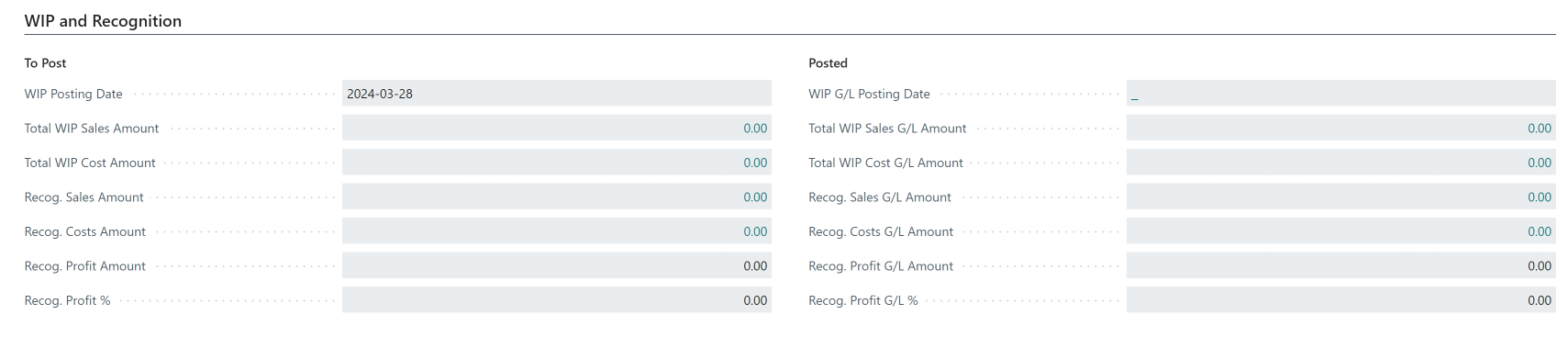

If you run the Calculate WIP process again, the system will Calculate WIP and populate the WIP and Recognition Tab "To Post" side:

However, upon running the Post WIP to G/L process,

- the "to Post" side will drop back to zero.

- The G/L side will receive postings again, but they will net themselves out. In other words, G/L side Balances will not be affected.

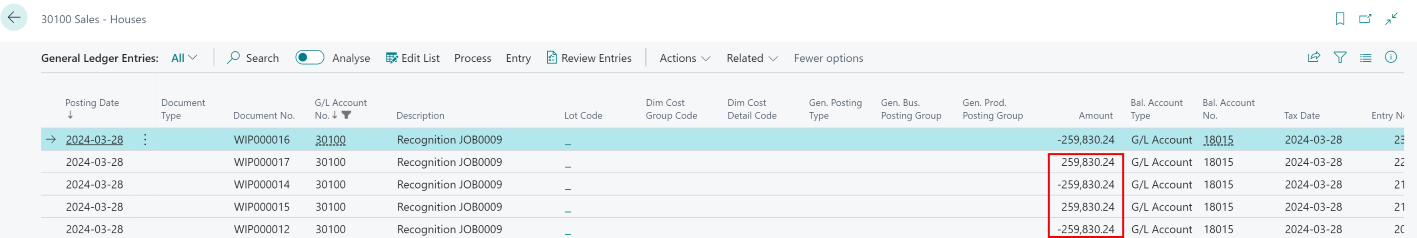

In the illustration above, the Calculate WIP process and Post WIP to G/L were run 2 times in addition to the original. (3 times total) We can observe two sets of offsetting entries, leaving the Recognized sales account with the original balance of -259,830.24

Setting the Project status to Complete

Note

In real life, you are going to repeat the process as described above until you complete your project.

The lot is sold for 600,000 and the invoice was posted. Planning Lines are affected and Phase and Lot Dimensions are recorded.

- To learn more about the sales process, read: Selling.

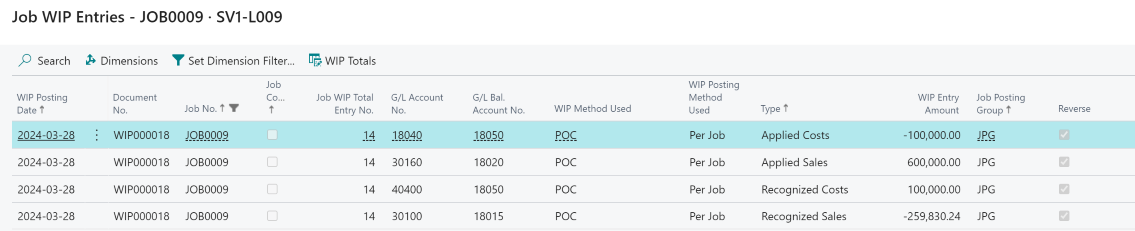

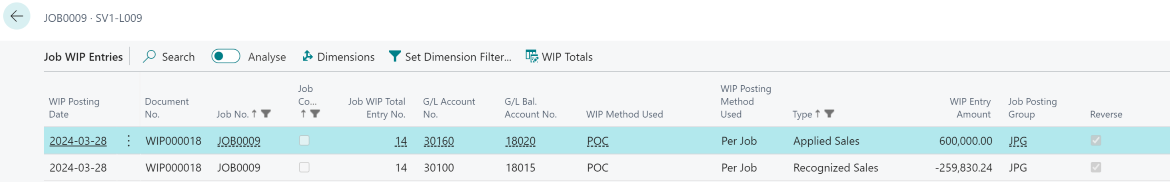

On the Project Card (relevant to the transaction- here Lot 9) go to the WIP Menu, then Calculate WIP. This will result in the following Project WIP subledger entries:

- Note that all transactions are part of a reversal.

The system Calculated a Total WIP Sales Amount of (A debit on the Sales Account) 340,169.76, (600,000-259,830.24) which is a result of the following entries:

WIP and Recognition:

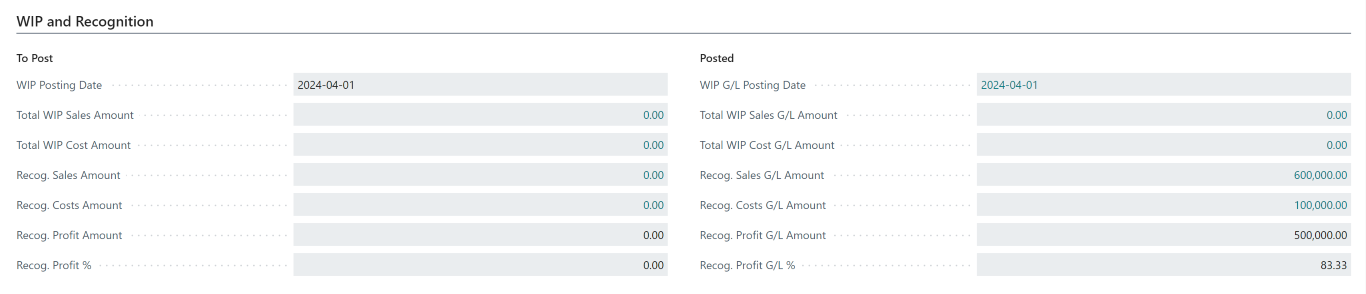

Now go to the WIP menu, and run Post WIP to G/L resulting in WIP and Recognition:

-Note that Total WIP Sales G/L Amount is consistently showing the remaining value to be posted for sales 600,000-259,830.24=340,169.76

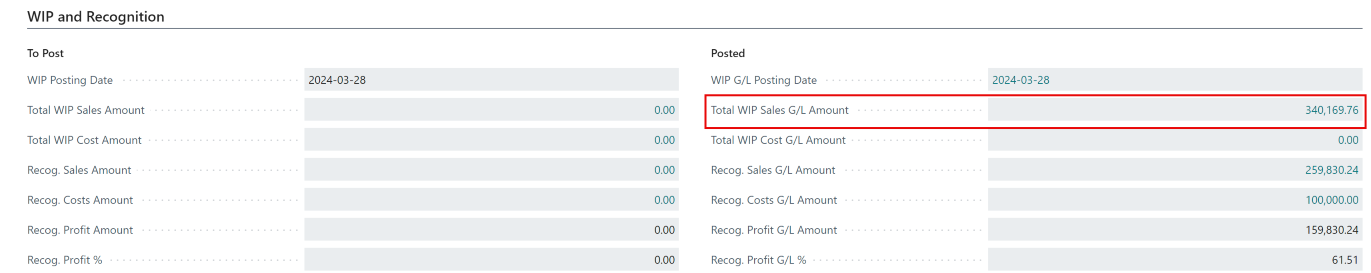

On the COA side, we will have:

- Note that the balances will still need to be cleared by setting the Project Status to Completed. For example:

- The 30100 Sales Houses account still recognized only the initial revenue CR 259,830.24 and NOT the 600,000 invoiced amount.

- Account 40400 has a balance of the invoiced 100,000

Set the Project status to Complete

To finish the project, on the Project Card go to the Posting FastTab and change the Project Status from Active to Completed.

- At this point, the system will recommend: "You must run the Project Calculate WIP function to create completion entries for this Project. Do you want to run this function now?."

- Answer Yes.

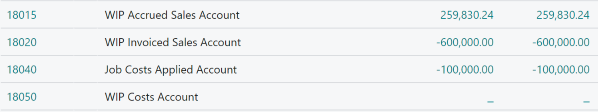

Running the Project will result in these Project WIP Entries:

and the following result on the WIP and Recognition Screen:

- At this point, the system will recommend: "You must run the Project Post WIP to G/L function to post the completion entries for this Project. Do you want to run this function now?

- Answer Yes.

This is the final step. The accounting outcomes on the WIP and Recognition screen are:

WIP and Recognition balances result from the following underlying G/L entries:

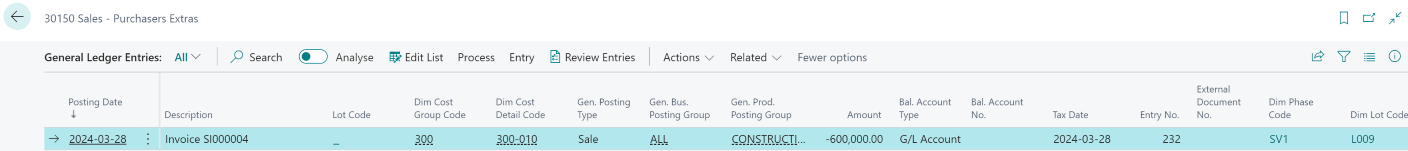

The recognized Sales Account 30100 was credited with the full 600,000, and 30160 Project Sales Applied was the balancing account.

- Both entries were recorded in revenue accounts and thus have a neutral impact on the revenue

- The revenue was correctly recorded ONCE only in the 30150 as a credit with the Accounts Receivable 12000 Account with 600,000 on the debit side.

- Note that the Phase and Lot Dimension Codes are properly recorded in this posting.

The revenue was correctly recorded ONCE only in the 30150 as it is setup as a Sales Account in the General Posting Setup:

The Cost of Sales - Construction 40400 (Cost Account)- after a series of "ins and outs" finished with the full balance of costs on the debit side, i.e, 100,000 with 18040 Project Costs Applied Account as balancing account. Accounts Payable has 100,000 on the credit side waiting to be settled with the Vendor.

For the re-opening completed contract scenario, go to the section WIP Re-opening Completed Contract.

WIP Completed Contract Method

Note

- This Article builds upon the section, Work In Process (WIP) in HomeBuilder

- The article WIP Percent of Completion Method explains the mechanics of the numbers flow between the WIP subledger and the G/L. It may be beneficial to familiarize yourself with its contents if you are a controller or perform administrative tasks in this area.

- In 2024, Business Central changed the table/ functionality name from Jobs to Projects. The screenshots still contain the old name, i.e., Jobs

As mentioned before, the Completed Contract does not recognize revenue and costs until the Project is complete. You may want to use this method when there is high uncertainty around the estimates of costs and revenue for the Project.

All usage is posted to the WIP Costs account (asset), and all invoiced sales are posted to the WIP Invoiced Sales account (liability) until the Project is complete.

You start with the same setup as for the Percent of Completion Method. This article runs parallel to the Percent of Completion Method; therefore, the first section, "WIP Percent of Completion Method," and the second section, "Calculate WIP Action," are repeated and omitted in this article.

Here is what the omitted 2 sections from the Percent of Completion Method contain in summary:

- WIP accounts have no postings.

- In WIP and Recognition FastTab there is nothing to post (and nothing is posted).

To start, ensure that on the Project Card, posting FastTab, the WIP Method is set to Completed Contract and the Project Status is set to Open.

At this point, you can post 100,000 costs to your Planning Lines

- To Purchase, use Purchase Invoice Card, then from the Process Menu, select Populate from Planning Lines just like in the Percentage of Completion Method

- Note that when using Populate from Planning Lines:

- The thick "Apply to the Planning Line" is marked.

- Dim Cost Group Code, Dim Cost Detail Code, Dim Phase Code, and Dim Lot Code are going to be populated from the Planning Line. See the highlighted part of the screenshot.

- 22000 is Accounts Payable account.

Now, on the Project Card, from the WIP Menu, select Calculate WIP That Action will result in the following Project WIP Entry:

On the WIP and Recognition Tab, you have 100,000 on the left, i.e.: To Post, side.

- Note that this is not in the General Ledger yet.

The next step is to post to the General Ledger. From the WIP Menu, select Post WIP to GL. It will result in the following Project WIP General Ledger Entries:

In this part of the example, you will sell the house to a customer. From the list of customers, choose the one assigned to the Lot you work on. On the Customer Card, from the New Document menu, select Sales Invoice.

- It will pull up the Sales Invoice Card populated with this Customer information.

From the Process Menu, select Populate from Planning Lines Action Button. Upon the invoice posting:

- Note that the 30150 on the credit side received the Dim Cost Group Code, Dim Cost Detail Code, Dim Phase Code, and Dim Lot Code. This Account is set as a Sales Account in the General Posting Setup. 12000 Account, receiving debit entry is the AR account.

During your regular company operations, you will keep adding costs and perhaps sell Selection Packages (Color Charts). In the example, however, you will be finalizing the Project Closing Process. From the WIP Menu, select Calculate WIP. The system will prepare these Project WIP entries:

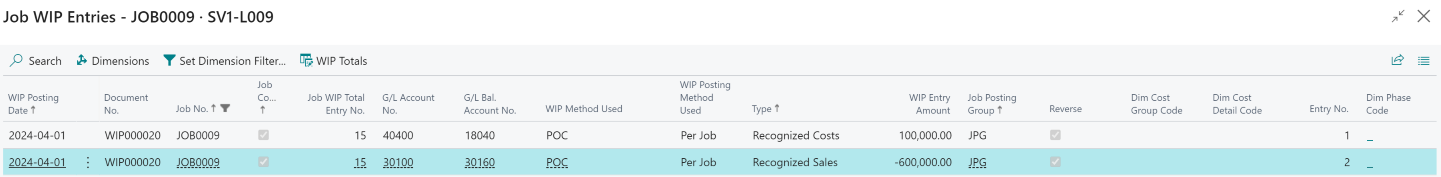

Your Total WIP and Sales amount and Cost Amount are ready to be posted:

From the WIP Menu, select Post WIP to G/L. This will post WIP "To Post" amounts to the Posted Section and will Post to the General Ledger:

Note that none of the costs or revenue is recognized yet. Since this is a Completed Contract Method, any recognition will take place once, on the Project Card, you go to the Posting FastTab and set the Contract Status from Open to Completed.

The following Project WIP Entries (no effect on G/L yet) and no Dimension information:

resulted in the following WIP and Recognition- "To Post" side numbers:

After posting WIP to G/L:

You can drill into any of the lines to see where the balances ended up, i.e.:

- Recognized Sales (Costs/Profit) G/L Amount.

or go to your COA. As a reminder, these are the accounts specified in the Project Posting Groups page. E.g. the Recognized Sales Account 30100

And your costs in 40400:

WIP Re-opening Completed Contract

This scenario starts with the setup and postings described in the WIP Percent of Completion Method.

As a reminder, the WIP and Recognition FastTab:

- Note that all revenue (600,000) and all costs are in the Recognized Sales account and the Recognized Costs account (100,000)

From the Job card, Posting FastTab, set the (Job) status from Completed to Open.

- The system will display a warning message: "This will delete any unposted WIP entries for this job and allow you to reverse the completion postings for this job. Do you wish to continue?"

- Upon continuation, there will appear another warning message: "You must run the Job Post WIP to G/L function to reverse the completion entries that have already been posted for this job."

- At this point, no changes to G/L took place.

You can choose to "Run the Job Post WIP to G/L function to reverse the completion entries that have already been posted for this job" or not. Typically, what happens is that you will be adding additional revenue (e.g., Selection Packages- Colour Charts) or additional costs. Therefore, you can just add this additional revenue or costs, then follow the process described in detail in the WIP Percent of Completion Method (An alternative method, Completed Contract, is similar from the "mechanical" perspective, and you can use it as well.)

In short, the last steps will be:

- Run WIP.

- Post WIP to GL.

- Set the project Status to Complete.

All additional revenue will end up in the Recognized Sales account, and additional costs will end up in the Recognized Costs account.